New Features

Ways to Create Alternative Source of Income for Salaried Employees

June 12, 2024

3 Min Read

In today’s rapidly evolving economic landscape, the concept of job security has taken on new meaning. Salaried employees are increasingly recognizing the importance of creating alternative sources of income to bolster financial stability. If you find yourself contemplating the question, “How can I create an alternative source of income as a salaried employee?” you’re not alone. Let’s explore practical and feasible ways to diversify your income streams.

Utilize your skills and expertise to offer freelance services or consultancy in your spare time. Whether it’s graphic design, writing, programming, or marketing, freelancing platforms provide a gateway to connect with clients seeking your skills. This not only provides an additional income stream but also allows you to expand your professional network and enhance your skills.

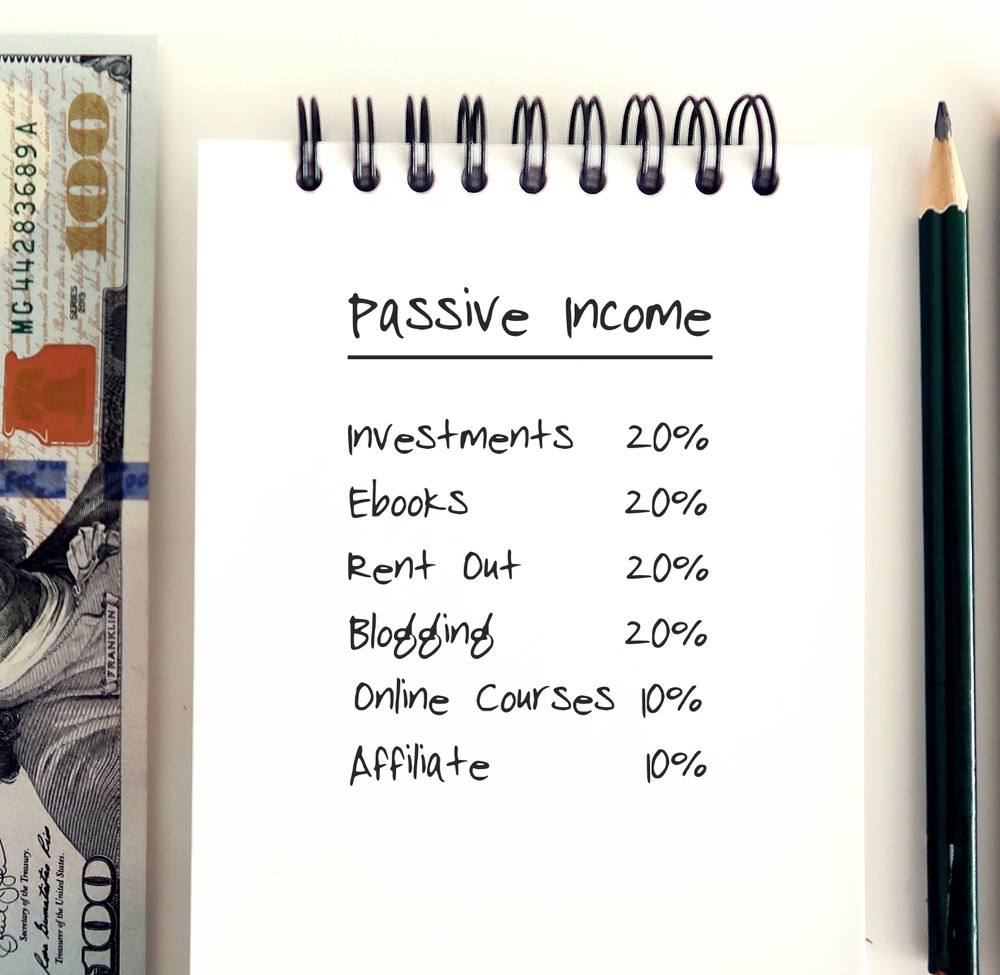

Consider investing in the stock market as a means of generating passive income. By strategically selecting stocks with growth potential or dividend-paying stocks, you can build a diversified portfolio. Regularly investing a portion of your salary in stocks has the potential to generate returns over time, creating an alternative income source.

If you have a spare room, property, or even a parking space, consider renting it out. Platforms like Airbnb make it easy to rent your space to travelers, while renting out a parking spot in a high-demand area can provide a steady stream of income with minimal effort.

Share your knowledge and expertise by creating and selling online courses or hosting webinars. Platforms like Udemy and Teachable allow you to reach a global audience, providing an opportunity to earn passive income as individuals enroll in and purchase your courses.

Explore affiliate marketing as a way to monetize your online presence. By promoting products or services through affiliate links on your blog or social media, you can earn a commission on sales generated through your referral. This can be a seamless way to create passive income, especially if you already have an established online platform.

Engage in part-time or gig work to supplement your income. Whether it’s driving for rideshare services, delivering groceries, or offering handyman services, the gig economy provides flexible opportunities to earn extra income on your own schedule.

Turn your hobbies or creative talents into a source of income by creating and selling digital products. This could include anything from e-books and photography to digital artwork and printables. Online platforms make it easy to showcase and sell your creations to a global audience.

Investing in real estate no longer requires large sums of money or hands-on management. Real estate crowdfunding platforms allow individuals to pool their resources to invest in properties. This enables you to benefit from real estate income and appreciation without the need to directly manage properties.

Don’t let your car gather dust! Join Zoomcar Host and unlock a new revenue stream with minimal effort. Turn your underused vehicle into a valuable asset, generating passive income through convenient self-drive rentals. Zoomcar Host’s seamless platform takes care of everything, from listing your car to managing bookings and secure transactions, so you can focus on earning, not on the process. Contribute to a sustainable future of shared mobility and watch your income grow, one rental at a time.

Automate your investments by setting up regular contributions to retirement accounts, mutual funds, or other investment vehicles. This disciplined approach ensures that a portion of your salary is consistently allocated to investments, potentially growing over time and providing an alternative source of income for salaried employees in the future.

To sum up, creating alternative sources of income for salaried employees involves a combination of leveraging skills, embracing technology, and adopting a proactive mindset. Diversifying your income not only provides financial security but also opens up opportunities for personal and professional growth. Remember, the key lies in finding a balance that complements your lifestyle and aligns with your interests. By exploring these avenues and taking strategic steps, you can embark on a journey to financial independence and resilience.

©2025 Zoomcar Terms